UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.

_____)Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ |

| | |

Filed by the Registrant ý | |

Filed by a Party other than the Registrant o | |

| | |

| Check the appropriate box: | |

| | |

o | Preliminary Proxy Statement | |

¨o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

xý | Definitive Proxy Statement | |

¨o | Definitive Additional Materials | |

¨o | Soliciting Material Pursuant to § 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

Not

Applicable applicable

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

¨ | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | |

| | | | | | |

| | | (1) | | Title of each class of securities to which transaction applies: | | |

| | | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: | | |

| | | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set

0‑11 (set forth the amount on which the filing fee is calculated and state how it was | | |

| | | | | | determined): |

| | | | | determined): | | |

| | | | | | |

| | (4) | | Proposed maximum aggregate value of transaction: | | |

| | | | | | |

¨ | o | Fee paid previously with preliminary materials. |

¨ | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) Amount previously paid: |

| | (1)(2) Form, Schedule or Registration Statement No.: |

| (3) Filing party: |

| (4) Date filed: |

|

| | |

| | Amount previously paid:2018 Proxy Statement 1 |

|

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: | | |

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

|

| | |

| When: | | Friday,Thursday, May 13, 201617, 2018 at 9:00 a.m. Central time.Time. |

| |

Where: | | |

| Where: | 11 Greenway Plaza, 25th Floor Houston, Texas 77046 |

| | |

| Matters to be Voted on: | ü | | üElect ten Trust Managers to hold office for a one-year term.

üRatify Deloitte & Touche LLP as our independent registered public accounting firm for 2016.2018. üHold an advisory vote on executive compensation.üApprove the 2018 Share Incentive Plan. ü Approve the 2018 Employee Share Purchase Plan. ü Act on any other matter which may properly come before the meeting. |

| | |

| Who Can Vote: | | Shareholders who are holders of record of common shares at the close of business on March 16, 201620, 2018 will be entitled to vote at the annual meeting. |

| | |

| Contact: | | Please contact investor relationsInvestor Relations at (800) 922-6336 or (713) 354-2787 with any questions. |

| | |

| | By Order of the Board of Trust Managers,

|

|

/s/ Josh Lebar

|

| /s/ Josh Lebar |

| | Josh Lebar Senior VicePresident-General Counsel and Secretary |

|

March 24, 201623, 2018 |

|

| | | | | |

| Important Notice Regarding Availability of Proxy Materials for our Annual Meeting of Shareholders to be held on May 13, 2016 17, 2018 The proxy statement and annual report to shareholders are available at www.proxyvote.com and in the investor relations Investors' section of our website at www.camdenliving.com under “SEC Filings”.

|

|

|

|

| | |

| | 20162018 Proxy Statement

|

The Board of Trust Managers of Camden Property Trust (the “Company” or “Camden”) is soliciting proxies to be used at the annual meeting. The proxy materials are first being sent on or about March 24, 2016 to all shareholders of record on March 16, 2016, which is the record date for the annual meeting. The complete mailing address of the Company’s executive offices is 11 Greenway Plaza, Suite 2400, Houston, Texas 77046.

| | |

| | 2016

|

|

| | | | |

| | TABLE OF CONTENTS |

| | TRUST MANAGERS’ LETTER TO SHAREHOLDERS | | 2017 Compensation Decisions | |

| | Policy Regarding Clawback of Compensation | |

| | Q&A WITH LEAD INDEPENDENT TRUST MANAGER | | Deferred Compensation Plans and Termination Payments | |

| |

| | PROXY SUMMARY | | Employment Agreements | |

| | Meeting Agenda and Voting Recommendations | | Compensation Policies and Practices Relating to Risk Management | |

| | Trust Manager Nominee Highlights | |

| | Governance Highlights | | Compensation Tables | |

| | 2017 Business Highlights | | Summary Compensation Table | |

| | Key Points on Our Executive Compensation Program | | Grant of Plan Based Awards | |

| | Key Compensation Practices | | Employment Agreements | |

| | GOVERNANCE OF THE COMPANY | | Outstanding Equity Awards at Fiscal Year-End | |

| | Board Independence and Meetings | | Option Exercises and Shares Vested | |

| | Board Leadership Structure; Board Role in Risk Oversight | | Non-Qualified Deferred Compensation | |

| |

| | Executive Sessions | | Potential Payments Upon Termination or Change in Control | |

| | Board Meetings and Board Committees | |

| | Consideration of Trust Manager Nominees | | CEO Compensation Pay Ratio

| |

| | Guidelines on Governance and Codes of Ethics | | PROPOSAL 1 - ELECTION OF TRUST MANAGERS | |

| | Communication with the Board | | Required Vote | |

| | Share Ownership Guidelines | | AUDIT COMMITTEE INFORMATION | |

| | Short Selling and Hedging Prohibition | | Report of the Audit Committee | |

| | BOARD COMPENSATION | | Independent Registered Accounting Firm Fees | |

| | EXECUTIVE OFFICERS | | Pre-Approval Policies and Procedures | |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | PROPOSAL 2 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

| | EXECUTIVE COMPENSATION | | PROPOSAL 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

| | Compensation Committee Report | |

| | Compensation Committee Interlocks and Insider Participation | | PROPOSAL 4 - APPROVAL OF THE 2018 SHARE INCENTIVE PLAN | |

| |

| | Compensation Discussion and Analysis Overview | | PROPOSAL 5 - APPROVAL OF THE 2018 EMPLOYEE SHARE PURCHASE PLAN | |

| | Pay for Performance | |

| | Key Executive Compensation Performance Metrics of Achievement | | INFORMATION ABOUT VOTING AND THE ANNUAL MEETING | |

| |

| | Company's Compensation Philosophy | | SHAREHOLDER PROPOSALS | |

| | Determination of Compensation | | | |

| | Elements of Total Annual Direct Compensation | | Exhibit B - 2018 Employee Share Purchase Plan | |

| | The Board of Trust Managers of Camden Property Trust (the “Company” or “Camden”) is soliciting proxies to be used at our annual meeting. The proxy materials are first being sent on or about March 23, 2018 to all shareholders of record as of March 20, 2018, which is the record date for the annual meeting. The complete mailing address of the Company's executive offices is 11 Greenway Plaza, Suite 2400, Houston, Texas 77046. |

| |

| |

A LETTER TO

CAMDEN’SCAMDEN'S SHAREHOLDERS

from Our Board of Trust Managers

Dear Fellow Shareholders:

As Camden’s Board, we are committed to representing and protecting your interests by providing strategic oversight of the Company’s Executive Management team, with a focus on long-term value creation. We believe

that the Company’s strong balance sheet, sound strategic business plan, and solid operating performance are all key factors in the Company’s continued success.

Our Board is comprised of a highly-qualified and experienced group of leaders, with the founders of the Company, Ric Campo and Keith Oden, complementing the eightour independent Trust Managers. Good corporate governance is vital to the Company and its shareholders, and we are committed to ensuring that each of our Board members brings a strong balance of varying perspectives, capabilities, skillsets,skill sets, diversity, and experience to their role. We are committed to effective board refreshment, and our policy of Trust Manager retirement following their 75th birthday resulted in two Trust Managers retiring from the Board as of the date of the 2017 annual meeting of shareholders and the appointment of two new Trust Managers, Heather J. Brunner and Renu Khator, being appointed to the Board. We encourage you to review the qualifications and backgrounds of our current nominees for election to the Board beginning on page4950 of this proxy statement.

Our Board believes that consistently strong operating results equate to long-term shareholder value creation. Accordingly, we link, through our annual bonus program and the grant of performance and long-term equity-based incentive awards, a substantial portion of the compensation opportunities for our executive officers to performance and long-term shareholder value. So that we can continue to grant equity-based incentive awards, we are proposing that shareholders approve a new equity incentive plan, the 2018 Share Incentive Plan, as described beginning on page 60 of this proxy statement. To help align the interests of our employees generally with shareholder interests, we offer a share purchase program for our employees. So that we can continue this program in the future, we are also proposing that shareholders approve the 2018 Employee Share Purchase Plan, as described beginning on page 69 of this proxy statement.

We appreciate and value your interest, investment and support. To the extent

that you have any thoughts, concerns or recommendations they can be addressed to:

Mr. Lewis A. Levey

Lead Independent Trust Manager

11 Greenway Plaza, Suite 2400

Thank you for your confidence in us and your continued support of the Company.

Camden’s Board of Trust Managers |

| | | | |

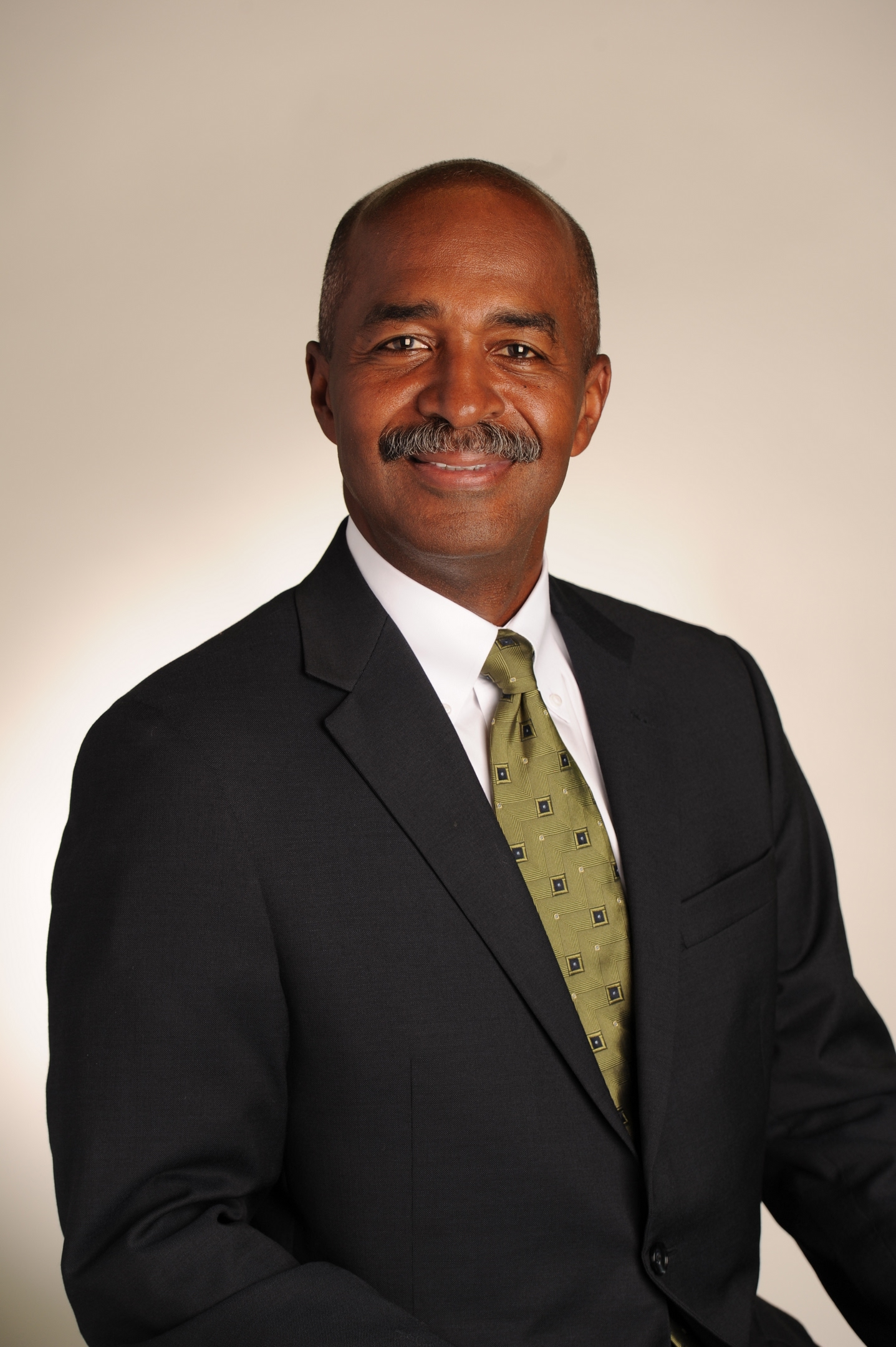

| Richard J. Campo | | William B. McGuire, Jr. | | Frances Aldrich Sevilla-Sacasa |

| | | | |

| Heather J. Brunner | | D. Keith Oden | | Steven A. Webster |

| | | | |

| Scott S. Ingraham | | F. Gardner Parker | | Kelvin R. Westbrook |

| | |

Lewis A. Levey | | William F. Paulsen | | Kelvin R. Westbrook |

| | | | |

| Renu Khator | | | | |

| | | | |

|

| | |

William B. McGuire, Jr. | | Frances Aldrich Sevilla-Sacasa2018 Proxy Statement 1 | |

| | |

| | 2016 Proxy Statement 1

|

Q&A WITH OUR LEAD INDEPENDENT TRUST MANAGER

What do you see as the

Board’sBoard's role?

The primary role of the Board is to provide strategic oversight of the Company’s Executive Management team and its strategic business plan, while always representing the best interests of the Company’s shareholders. The Board reviews the Company’s strategic plans, assesses and monitors risks that might impact the Company, and

ensures thatoversees the establishment and maintenance of appropriate financial and internal

controls are established and maintained.controls. While assuring that the very positive culture of outstanding corporate governance is preserved, we are focused on regular, strong performance-related metrics, always mindful of the long-term goals and objectives of the

Company.Company and its stakeholders.

What is

yourthe role as the Lead Independent Trust Manager?

A comprehensive list of the duties and responsibilities for this role is provided in the Company’s Guidelines on Governance, as well as on page1412 of this proxy statement. I serveThe Lead Independent Trust Manager serves as the principal liaison between the Company’s Chairman of the Board/CEO and our independent Trust Managers, and presidepresides at any meetings at which the Chairman is not present (including regular Executive Sessions of independent Trust Managers). In an effort to maintain a thoroughly engaged, high-performance Board, I takethe Lead Independent Trust Manager takes a leadership role in identifying issues for the Board to consider and, working with the Chairman of the Board/CEO, establishestablishes the agenda for each meeting; assuring that the Trust Managers have sufficient information, resources, background, and time to adequately discuss and review the various issues included in the agenda, or otherwise brought before the Board. I believe that it is important that the Lead Independent Trust Manager help maintain the appropriate balance between the Board’s involvement in longer-term strategy and the Company’s operations, which are charged to our Executive Management team. I takeThe Lead Independent Trust Manager takes the primary role in providing feedback to the Company’s Chairman of the Board/CEO with respect to any issues or discussions which may occur in Executive Session without the presence of the Executive Management Team. Camden is committed to effective shareholder communication and I servethe Lead Independent Trust Manager serves as the primary contact for any shareholders wishing to communicate directly with the Board.

The Company’s Chief Executive Officer also serves as its Chairman of the Board. Do you believe that is an appropriate and effective structure for the Company?

We believe at the present time, combining the roles of Chairman and CEO, together with a strong Lead Independent Trust Manager, provides the appropriate leadership and oversight of the Company and facilitates the effective functioning of both the Board and the Executive Management team. The Board believes its responsibility to shareholders requires the Board retain the flexibility to determine the best leadership structure for the Company under any set of circumstances and personnel. By making decisions based on context, the Board is

better able to make determinations in the best interests of shareholders, including those related to the Company’s Board leadership structure.

On behalf of the entire Board, I want to express our dedication to maintaining an open dialog with shareholders, soliciting and considering your input and comments, with a further commitment to enhance our corporate governance program as appropriate. We very much value your support and

sincerely appreciate and thank you for the trust

and confidence you have placed in us.

Sincerely,

Lewis A. Levey

Kelvin R. Westbrook

Lead Independent Trust Manager

|

| | |

| | 20162018 Proxy Statement 2

|

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

MEETING AGENDA AND VOTING RECOMMENDATIONS

| | | | | | | | | | | | | | | | |

Item 1 | | Election of Trust Managers |

| | ü The Board of Trust Managers recommends you vote FOR the election of these candidates. |

|

Shareholders are being asked to elect 10 Trust Managers. The Company’s Trust Managers are elected for a term of one year by a majority of the votes cast. Additional information about each Trust Manager and his or her qualifications may be found beginning on page49. |

| | | | | | | | | | | Committee Memberships |

| Name | | Age | | Trust Manager Since | | Primary Occupation | | Independent | | A | | C | | N&G | | E |

Richard J. Campo | | 61 | | 1993 | | Chairman of the Board and Chief Executive Officer (“CEO”) of the Company | | | | | | | | | |  |

Scott S. Ingraham | | 62 | | 1998 | | Private Investor and Strategic Advisor | | ü | | ü | | | | ü | | |

| | | | | | | | | | | | | | | | | |

Lewis A. Levey | | 74 | | 1997 | | Private Investor and Management Consultant | | ü | | | | | | ü | | ü |

| | | | | | | | | | | | | | | | | |

William B. McGuire, Jr. | | 71 | | 2005 | | Private Investor | | ü | | | | | |  | | |

| | | | | | | | | | | | | | | | | |

D. Keith Oden | | 59 | | 1993 | | President of the Company | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

F. Gardner Parker | | 74 | | 1993 | | Private Investor | | ü | | | | ü | | ü | | |

| | | | | | | | | | | | | | | | | |

William F. Paulsen | | 69 | | 2005 | | Private Investor | | ü | | | |  | | | | ü |

| | | | | | | | | | | | | | | | | |

Frances Aldrich Sevilla-Sacasa | | 60 | | 2011 | | CEO of Banco Itaú International, Miami Florida | | ü | | ü | | | | | | |

Steven A. Webster | | 64 | | 1993 | | Co-Managing Partner and Co-CEO of Avista Capital Partners, L.P. | | ü | | | | ü | | | | |

Kelvin R. Westbrook | | 60 | | 2008 | | President and CEO of KRW Advisors, LLC | | ü | |  | | | | | | |

| | | | | | | | | | | | | | | | | |

|

A:Audit Committee C:Compensation Committee N&G:Nominating & Corporate Governance Committee E:Executive Committee  Chair ü Member Chair ü Member

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | |

| Item 1 | Election of Trust Managers |

| | ü The Board of Trust Managers recommends you vote FOR the election of these nominees. |

Shareholders are being asked to elect 10 Trust Managers. The Company’s Trust Managers are elected for a term of one year by a majority of the votes cast. Additional information about each Trust Manager nominee and his or her qualifications may be found beginning on page 50. |

| | | | | | Committee Memberships |

| Name | Age | Trust Manager Since | Primary Occupation | Independent | A | C | N&G | E |

| Richard J. Campo | 63 | 1993 | Chairman of the Board and Chief Executive Officer (“CEO”) of the Company | | | | | |

| Heather J. Brunner | 49 | 2017 | Chairwoman of the Board and CEO of WP Engine | ü | ü | | ü | |

| Scott S. Ingraham | 64 | 1998 | Private Investor and Strategic Advisor | ü | ü | | ü | |

| Renu Khator | 62 | 2017 | Chancellor of University of Houston System and President of University of Houston | ü | ü | ü | | |

| William B. McGuire, Jr. | 73 | 2005 | Private Investor | ü | | | | |

| D. Keith Oden | 61 | 1993 | President of the Company | | | | | |

| William F. Paulsen | 71 | 2005 | Private Investor | ü | | | | ü |

| Frances Aldrich Sevilla-Sacasa | 62 | 2011 | Private Investor | ü | | | | |

| Steven A. Webster | 66 | 1993 | Co-Managing Partner and Co-CEO of Avista Capital Partners, L.P. | ü | | ü | | |

| Kelvin R. Westbrook | 62 | 2008 | President and CEO of KRW Advisors, LLC | ü | | | | ü |

A: Audit Committee C: Compensation Committee N&G: Nominating & Corporate Governance Committee E: Executive Committee  Chair ü Member Chair ü Member |

|

| | | | | | | |

Item 2 | | Ratification of Independent Registered Public Accounting Firm | | | | Item 3 | | Advisory Vote to Approve Executive Compensation | | Item 4 | Approval of 2018 Share Incentive Plan

|

ü The Audit Committee of the Board of Trust Managers recommends that you vote FOR this proposal. We are asking shareholders to ratify the Audit Committee’s appointment of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accounting firm for 2016. 2018. Information on fees paid to Deloitte in 20142016 and 20152017 can be found on page5756.. | | | | ü The Board of Trust Managers recommends that you vote FOR this proposal.

We are asking shareholders to vote, in an advisory manner, to approve the executive compensation of our Named Executive Officers as described in the sections titled “Compensation DiscussionDiscussion and Analysis” beginning on page2524,, the 20152017 Summary Compensation Table on page3938, the accompanying compensation tables and the related narrative disclosure.disclosures. | | ü The Board of Trust Managers recommends that you vote FOR this proposal.

We are asking shareholders to approve the 2018 Share Incentive Plan as described in the section titled “Approval of 2018 Share Incentive Plan” beginning on page 60.

|

|

| | |

| | 20162018 Proxy Statement 3

|

|

| | |

Item 5 | Approval of 2018 Employee Share Purchase Plan | |

üThe Board of Trust Managers recommends that you vote FOR this proposal.

We are asking shareholders to approve the 2018 Employee Share Purchase Plan as described in the section titled “Approval of 2018 Employee Share Purchase Plan” beginning on page 69.

| |

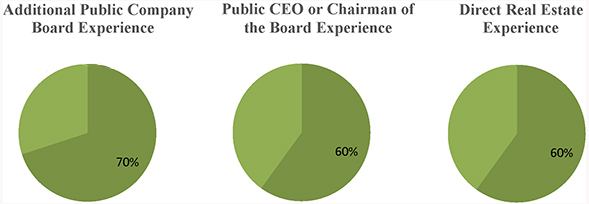

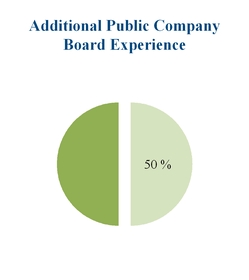

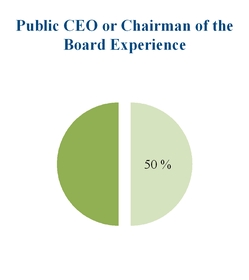

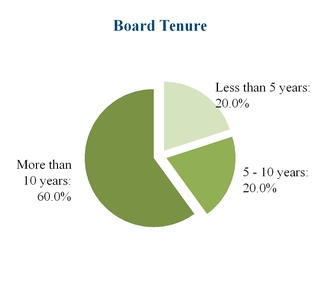

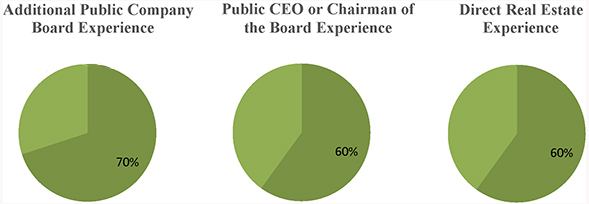

TRUST MANAGER NOMINEE HIGHLIGHTS

Our Trust

ManagersManager nominees bring a balance of experience and perspective. We believe our Board

nominee demographic is positive and enhances our goal to develop a culture of strong corporate governance.

We are committed to good corporate governance to promote the long-term interests of shareholders, strengthen management accountability and help maintain public trust in the Company. The Governance section beginning on page910 describes our governance framework, which includes the following highlights:

|  | Independent Audit, Compensation, and Nominating &and Corporate Governance Committees |

| l |  Annual Election of Trust Managers by Majority Vote | l | Regular Executive Sessions of Independent Trust Managers |

| l |  | l | Risk Oversight by Full Board and Committees |

| l |  Robust Trust Manager Nominee Selection Process | l | Anti-Hedging Policy |

| l |  | l | Share Ownership Guidelines |

|

| | |

| | 20162018 Proxy Statement 4

6 |

We have reshaped our portfolio over the past fourseveral years through strategic capital recycling and have experienced internal growth from our operating portfolio. ThisWe believe this has resulted in better operational efficiencies and overall Company performance. Key 2015Our key 2017 performance achievements are as follows: |

|  |

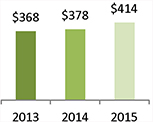

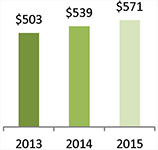

| l | Funds From Operations (“FFO”) for the twelve months ended December 31, 20152017 totaled $4.54$4.53 per diluted share or $414.5 million, our highest level as a public company.$424.1 million. |

| l |  | 20152017 Same Property Net Operating Income (“NOI”) increased 5.2%2.2%, ahead of the midpoint of our original guidance of 4.0%1.8%. |

| l |  | CompletedWe completed construction on seventhree communities with a total cost of $484$223.2 million, stabilized threetwo of these communities and an additional two previously completedpreviously-completed consolidated communities with a total aggregate cost of $222$221.9 million, and commenced construction on two new communities and a second phase of an existing consolidated community with a total budgeted cost of $231$228.0 million. |

| l |  | DisposedWe acquired one operating property, Camden Buckhead Square, comprised of three communities with an average age of 24 years250 apartment homes, located in Atlanta, Georgia for $147approximately $58.3 million. |

| l |  | Replaced our existing unsecured credit facility with an amended and restated facility, extending the maturity date until 2019 and expanding the sizeWe disposed of the facility to $600one 23-year old operating property located in Corpus Christi, Texas for gross proceeds of approximately $78.4 million. |

| l |  |

| l | PaidWe issued approximately 4.8 million common shares in a public equity offering and received approximately $442.5 million in net proceeds. |

| l | We paid an annualized dividend of $2.80$3.00 per share, andshare. In the first quarter of 2018, the Board declared a first quarter 20162018 dividend of $0.75$0.77 per common share, which is a 7.1%2.67% increase overto the Company’sCompany's prior quarterly dividend of $0.70 per share.dividend. |

KEY POINTS FROM THEON OUR EXECUTIVE COMPENSATION COMMITTEEPROGRAM  |

| Annual Incentives |

| l | Our Named Executive Officers’ annual incentives are directly tied to the achievement of predeterminedpre-established corporateand individual performance objectives. In 2015,2017, payouts for our executives were 100%113% of target, displaying alignment with actual performance, achievements.as discussed in the section "Short-Term Incentives," beginning on page 29. |

l

| Each of ourOur Named Executive Officers elected to receive 50% of their 20152017 bonus in shares displaying a strong confidence in our future growth potential. |

| Theand the majority of their compensation opportunity for Named Executive Officers is tied to future opportunity through share price growth, which we believe directly ties their financial well-being with thatinterests to those of our shareholders. |

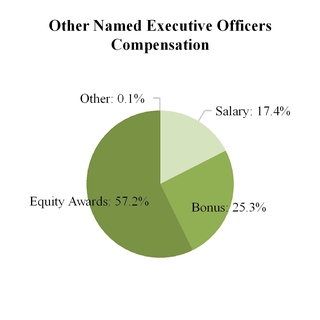

2015 COMPENSATION

The table below is the 2015 compensation for each Named Executive Officer.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Annual Bonus | | | | | | Long-Term

Compensation | | | | |

Name | | Salary | | | Cash

Bonus | | | Share

Award | | | Performance

Award | | | Share

Award | | | Total | |

Richard J. Campo | | $ | 502,655 | | | $ | 444,188 | | | $ | 666,281 | | | $ | 168,000 | | | $ | 1,517,366 | | | $ | 3,298,490 | |

D. Keith Oden | | | 502,655 | | | | 444,188 | | | | 666,281 | | | | 168,000 | | | | 1,517,366 | | | | 3,298,490 | |

H. Malcolm Stewart | | | 425,685 | | | | 248,745 | | | | 373,118 | | | | 140,000 | | | | 1,100,042 | | | | 2,287,590 | |

William W. Sengelmann | | | 327,818 | | | | 236,900 | | | | 355,350 | | | | 98,000 | | | | 550,021 | | | | 1,568,089 | |

Alexander J. Jessett | | | 324,451 | | | | 230,000 | | | | 345,000 | | | | 98,000 | | | | 516,055 | | | | 1,513,506 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

This table differs from compensation reported in the 2015 Summary Compensation Table in that it reflects the value of our Named Executive Officers’ long-term equity incentive awards in the performance year for which they were earned, rather than the year in which they were granted (e.g., long-term compensation awards granted in February 2016 for 2015 performance are shown in the table above as 2015 compensation). While compensation reported in the 2015 Summary Compensation Table is useful, the disclosure rules of the Securities and Exchange Commission (the “SEC”) do not take into account the retrospective nature of our executive compensation program and therefore create a one-year lag between the value of our Named Executive Officers’ long-term compensation awards and the performance year for which they were earned (e.g., long-term equity incentive awards granted in February 2016 for 2015 performance will not be shown in the Summary Compensation Table until our 2017 Proxy Statement as 2016 compensation). This table supplements, and does not replace, the 2015 Summary Compensation Table on page38.

|

| | |

| | 20162018 Proxy Statement 5

7 |

PAY FOR PERFORMANCE“The compensation of our Named Executive Officers should be and are tied to those performance metrics we

believe are most highly correlated to growth in long-term shareholder value”

William F. Paulsen, Compensation Committee Chairman

At Camden, both the Board and our management team believe strong operating results equate to long-term shareholder value creation. It is our goal to set challenging, yet achievable, goals for our management team. The following displays key performance metric achievements.

Key Performance Indicator Achievement1

|  | We consider FFO per share a key metric. In 2015, FFO per share was $4.54, ahead of the midpoint of our original guidance of $4.46. |

|  | Same Property NOI growth illustrates our ability to grow in current markets. In 2015, Same Property NOI growth was 5.2%, outpacing the midpoint of our original guidance of 4.0%.2 |

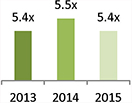

|  | In an effort to maintain appropriate and manageable levels of debt, the Company utilizes the Debt-to-EBITDA3 Ratio as a key metric. In 2015, our ratio was 5.4x, improving from 2014’s ratio of 5.5x. |

|  | We are constantly assessing our properties and future growth opportunities. The performance of our individual properties is extremely important. As such, yields from stabilized new development projects are a key metric. 2015 yields on stabilized new development projects were an average of 0.13% ahead of pro forma yields. |

|  | Our average annual share price increased again, creating additional value for our shareholders. As the graphic on page 7 depicts, we have experienced consistent long-term growth. |

1 A reconciliation of net income attributable to common shareholders to FFO, EPS and EBITDA for the year ended December 31, 2015 is contained in the Company’s 2015 Annual Report on Form 10-K and/or in its earnings release furnished on a Current Report on Form 8-K filed on January 29, 2016.

2The Company defines same property communities as communities owned and stabilized since January 1, 2014 and defines NOI as total property income less property operating and maintenance expenses less real estate taxes. The Company considers NOI to be an appropriate supplemental measure of operating performance to net income attributable to common shareholders because it reflects the operating performance of our communities without allocation of corporate level property management overhead or general and administrative costs

3Defined by the Company as earnings before interest, taxes, depreciation and amortization (“EBITDA”), excluding equity in (income) loss of joint ventures, (gain) loss on sale of unconsolidated joint venture interests, gain on acquisition of controlling interest in joint ventures, gain on sale of operating properties including land, net of tax, and income (loss) allocated to non-controlling interests. The Company considers EBITDA to be an appropriate supplemental measure of operating performance to net income attributable to common shareholders because it represents income before non-cash depreciation and the cost of debt, and excludes gains or losses from property dispositions.

| | |

| | 2016 Proxy Statement 6

|

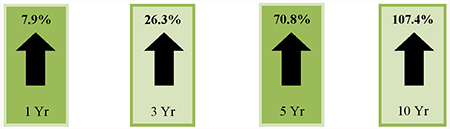

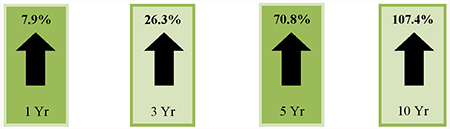

The Company has delivered consistent positive return to shareholders over time as shown below:

Camden Total Shareholder Return

As

Total shareholder returns are presented as of December 31,

20152017 and calculated assuming dividend reinvestment in our common shares. (Source: KeyBanc Capital Markets)

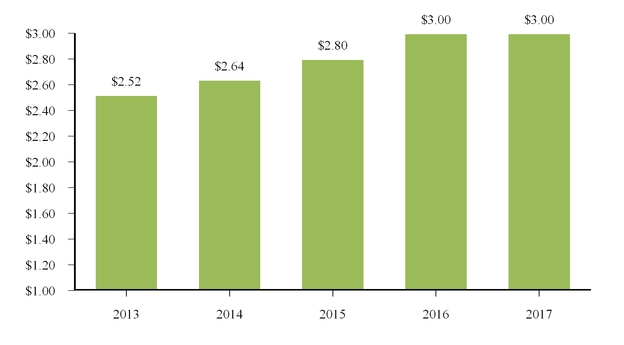

The Company also has a long history of

maintaining or increasing annual distributions to shareholders, as shown below.

5 Year Annual Distribution History1

1

1

Annualized dividend rate based upon the dividends on a Camden common share approved rate declared by the Board.Board for the applicable year (not when the dividend was actually paid) and excludes a special cash dividend of $4.25 per share paid on September 30, 2016 consisting of gains on dispositions of properties.

Returned to Shareholders from 20112013 through 201520172

|

| | |

| | 20162018 Proxy Statement 7

8 |

2 Includes a special cash dividend of $4.25 per common share paid to our shareholders of record as of September 23, 2016.

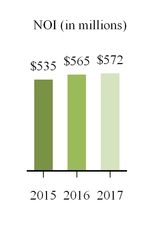

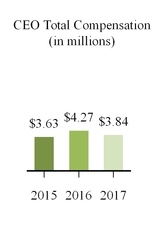

Directional Relationship Between Pay and Key Metrics

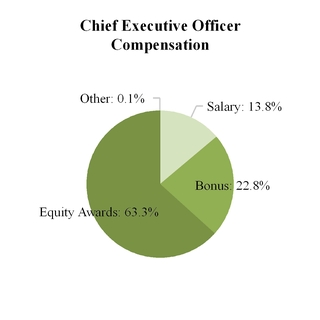

The following illustrates the directional relationship between Company performance, based on three of our key operating metrics (FFO, NOI and Debt toNet Debt/Adjusted EBITDA ratio), and the compensation of our CEO.CEO1. 1 See Summary Compensation Table at Page 39 for calculation.

KEY COMPENSATION PRACTICES

WHAT WE DO

KEY COMPENSATION PRACTICES

WHAT WE DO

| | |

ü DeferClassify a significant portion of our Named Executive Officers’ total pay through the use ofas time-based vesting of equity awards subjectingto promote retention and tie the value of suchthese awards to future Company share price performance | | |

| | ü Use pre-determined objectives to determine Named Executive Officer compensation |

ü Use a structured approach for CEO compensation decisions | | |

| | |

üApply sizable share ownership guidelines for Named Executive Officers | | |

| | |

üProhibit Named Executive Officers from hedging their Company shares, which precludes entering into any derivative transaction on Company shares (e.g., short sale, forward, option, collar) | | |

| | |

üIn-depth review of CEO’s and other Named Executive Officers’ goals and performance by an independent Compensation Committee | | made up of members of the Company’s Board of Trust Managers |

| | |

üUtilize an independent compensation consultant | | |

| | |

üSubject cash incentives and equity awards to clawback and forfeiture provisions | | |

| | |

|

| | |

| | 20162018 Proxy Statement 8

9 |

GOVERNANCE OF THE COMPANY

Board Independence and Meetings

The Board believes the purpose of corporate governance is to ensure the CompanyCamden maximizes shareholder value in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices the Board believes promote this purpose, are sound, and represent best practices. The Board continually reviews these governance practices, the rules and listing standards of the New York Stock Exchange (“NYSE”) and SECSecurities and Exchange Commission ("SEC") regulations, as well as best practices suggested by recognized governance authorities. Currently, the Board has ten

members.members (eight of which are independent), each of whom are nominated for reelection. To determine which of its members are independent, the Board used the independence standards adopted by the NYSE for companies listed on

such exchangethe NYSE and also considered whether a Trust Manager had any other past or present relationships with the Company which created conflicts

of interest or the appearance of

conflicts.conflicts of interest. The Board determined no Trust Manager, other than Richard J. Campo and D. Keith Oden, each of whom is employed by the Company, has any material relationship with the Company under the NYSE standards. As a result, the Company has a majority of independent Trust Managers on its Board as required by the listing requirements of the NYSE.

Board Leadership Structure; Board Role in Risk Oversight

Of the eight independent Trust Managers nominated for

re-electionreelection at the

annual meeting,

fivefour are currently serving or have served as a CEO and/or chairman of the board of public companies. With respect to the Company’s

threefour other independent Trust

Managers,Manager nominees, one was the founder and has been the CEO or senior executive of large media companies, one

ishas been a senior executive of an international financial institution and has been the dean of a large public school of business administration,

one is the CEO and Chairwoman of a privately-held technology company, and one

was a co-founder and a senior executiveis the Chancellor of a

large public

multifamily company.university system. Accordingly,

the Company believeswe believe all of

itsthe Company’s independent Trust

ManagersManager nominees have demonstrated leadership in large enterprises and all are familiar with board processes. For additional information about the backgrounds and qualifications of the Trust

Managers,Manager nominees, see “Proposal 1 - Election of Trust Managers” in this proxy statement.

The Board currently has three committees comprised solely of independent Trust

Managers—Audit,Managers - Compensation,

and Nominating and Corporate

Governance—withGovernance, and Audit-with each having a separate chair. Among various other duties set forth in the committee charters, (a) the Compensation Committee oversees the annual performance evaluation of the Company’s Chairman of the Board and CEO, President and other Named Executive Officers, (b) the Nominating and Corporate Governance Committee is responsible for succession planning and monitors Board performance,

and best practices in corporate governance and the composition of the Board and its committees, and (c) the Audit Committee oversees the accounting and financial reporting processes as well as legal, compliance and risk management matters. The chair of each of these committees is responsible for directing the work of the committee in fulfilling these responsibilities.

The entire Board is actively involved in overseeing risk management; however

in accordance with NYSE requirements, the Audit Committee charter provides for the Audit Committee to discuss with management guidelines and policies to govern the process by which risk assessment and risk management is handled, including the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. Management regularly provides updates on risk management to the Audit Committee and the entire Board, and the Board regularly discusses the most significant market, credit, liquidity and operational risks the Company is facing. The Board also engages in regular discussions regarding risk management and related matters with the Company’s CEO, President, Chief Financial Officer, and other officers as the Board may deem appropriate.

In addition, each of the Board committees considers the risks within its area of responsibilities. For example, the Compensation Committee considers the risks which may be

implicated byassociated with the executive compensation programs.

The Company believesWe believe the leadership structure of the Board supports the Board’s effective oversight of risk management.

| | |

| | 2016 Proxy Statement 9

|

In accordance with the Company’s Bylaws and Guidelines on Governance, the Board is responsible for selecting the CEO and the Chairman of the Board. The Company’s Bylaws provide the Board will annually select annually the Chairman of the Board based upon such criteria as the Nominating and Corporate Governance Committee of the Board recommends and the

Trust Managers believe to be in the best interests of the Company at a given point in time, and this process will include consideration of whether the roles of Chairman of the Board and CEO should be combined or separated based upon the Company’s needs and the strengths and talents of

itsour executives at any given time.

Since the Company’s IPO in 1993, the Company’s Chairman of the Board has also served as its CEO. Over this period, Mr. Campo has held both of these positions, and Mr. Oden has served as President with responsibility for the management of the Company’s operations. Messrs. Campo and Oden are the Company’s co-founders and have partnered to lead the Company’s growth and success. Having Mr. Campo serve as both Chairman of the Board and CEO has eliminated the potential for confusion or

duplication ofduplicated efforts. The Company’s Guidelines on Governance

have at all times requiredrequire the appointment of a Lead Independent Trust Manager.

TheWe believe the Company

believes it has been well-served by this leadership structure and having one person serve as CEO and Chairman of the Board, coupled with a Lead Independent Trust Manager, is best for the Company and

itsour shareholders.

Under the Company’s Bylaws and Guidelines on Governance, the Chairman of the Board is responsible for chairing Board meetings and annual shareholder meetings, setting the agendas for these meetings in consultation with the Lead Independent Trust Manager, and providing information to Board members in advance of

each Board meeting and between Board meetings. Under the Company’s Guidelines on Governance, any Board member may recommend the inclusion of specific agenda items to the Chairman of the Board, the Lead Independent Trust Manager, or the appropriate committee chair and such recommendations will be accommodated to the extent practicable. Under the Company’s Guidelines on Governance, the Lead Independent Trust Manager is responsible for the following:

|

| ● |

| l | presiding at all meetings of the Board at which the Chairman of the Board is not present; | |

| l | ● | | calling,convening, developing the agenda for and presiding at executive sessions of the independent Trust Managers, and taking the lead role in communicating to the Chairman of the Board any feedback, as appropriate; | |

| ● | l | assisting in the recruitment of Board candidates; | |

| ● | l | serving as principal liaison between the independent Trust Managers and the Chairman of the Board; | |

| ● | l | communicating with Trust Managers between meetings when appropriate; | |

| ● | l | consulting with the Chairman of the Board regarding the information, agenda and schedules of the meetings of the Board; | |

| ● | l | monitoring the quality, quantity and timeliness of information sent to the Board; | |

| ● | l | working with committee chairs to ensure committee work is conducted at the committee level and reported to the Board; | |

| ● | l | facilitating the Board’s approval of the number and frequency of Board meetings, as well as meeting schedules to assure there is sufficient time for discussion of all agenda items; | |

| ● | l | recommending to the Chairman of the Board the retention of outside advisors and consultants who report directly to the Board on Board-wide issues; | |

| ● | l | being available, when appropriate, for consultation and direct communication with shareholders and other external constituencies, as needed; and | |

| ● | l | serving as a contact for shareholders wishing to communicate with the Board other than through the Chairman of the Board. |

| |

|

| | |

| | 20162018 Proxy Statement 10

11 |

Pursuant to the Company’s Guidelines on Governance, our independent Trust Managers have regularly scheduled executive sessions in which they meet without the presence of management or employee Trust Managers. These executive sessions typically occur before or after each regularly scheduled meeting of the Board. Any independent Trust Manager may request an additional executive session

to be scheduled. The

presidingLead Independent Trust Manager

presides over these executive

sessions is the Lead Independent Trust Manager.sessions. We believe the responsibilities assigned to the Lead Independent Trust Manager are consistent with generally accepted requirements for a “countervailing governance structure”

wherewhen a company does not have an independent board chairman.

We believe, in addition to fulfilling the Lead Independent Trust Manager responsibilities, the Trust Managers who have served as Lead Independent Trust Manager have made valuable contributions to the Company. The following have been among the most important contributions of the Lead Independent Trust Manager:

|

| |

| | ● |

| l | monitoring the performance of the Board and seeking to developdeveloping a high-performing Board by for example, helping the Trust Managers reach consensus, keeping the Board focused on strategic decisions, taking steps to ensure all the Trust Managers are contributing to the work of the Board, and coordinating the work of the Board committees; |

| ● | l | developing a productive relationship with the Chairman of the Board and Board/CEO and ensuring effective communication between the Chairman of the Board and Board/CEO and the Board; and |

| ● | l | supporting effective shareholder communications. |

| |

On an annual basis, as

As part of

ourthe review of the Company’s corporate governance and succession planning, the Board (led by the Nominating and Corporate Governance Committee)

annually evaluates the Board leadership structure to ensure it remains the optimal structure for the Company and its shareholders.

We recognize different board

Board leadership structures may be appropriate for companies with different histories and cultures, as well as companies with varying sizes and performance characteristics.

We believe the Company’s current leadership structure—under which itsOur CEO serves as Chairman of the Board

but the Board committees

(other than the Executive Committee) are

composed of and chaired by

and all of the members are, independent Trust

Managers, and aManagers. In addition, our Lead Independent Trust Manager assumes specified responsibilities on behalf of the independent Trust

Managers—remainsManagers. We believe this is the optimal board leadership structure for the Company and

itsour shareholders.

Board Meetings and Board Committees

All of the Trust Managers attended 75% or more of meetings of the Board and the committees on which they served during

2015.2017. We encourage all of our Trust Managers to attend the annual

meeting. Allmeeting and all of

theour Trust Managers except

Mr. Websterfor one were present at last year’s annual meeting.

| | |

| | 2016 Proxy Statement 11

|

The following table identifies each committee of the Board, its members

during 2017, its key functions and the number of meetings held during

2015.2017. Each member of the Audit, Compensation, and Nominating and Corporate Governance Committees satisfies the applicable independence requirements of applicable law, the SEC and NYSE.

Written charters of theEach committee reviews its respective

committees are reviewedwritten charter on an annual basis.

|

| | | |

| | | | | | | | |

| Committee | | Key Responsibilities | | | | Members | | 2015

2017 Meetings |

| | | | | | | | |

Camden Property Trust Board of Trust Managers | | ●

l Shareholder advocacy; and●

l Risk Oversightoversight | | | | Independent Lead Trust Manager:Lewis A. Levey

Kelvin R. Westbrook | | 67 |

| | | | | | | | |

Charter last amended October 28, 2015 25, 2016 | | ● Overseeing

l Oversee the integrity of the Company’s consolidated financial statements and its compliance with legal and regulatory requirements;● Supervising

l Supervise the Company’s internal audit function;● Overseeing

l Oversee the independent registered public accounting firm’s qualifications, and independence and the performance of the Company’s independent registered public accounting firm;● Appointingperformance;

l Appoint and replacingreplace the independent registered public accounting firm, approving the engagement fee of such firm and pre-approving audit services and any permitted non-audit services; and● Reviewing,

l Review, as it deems appropriate, the adequacy of the Company’s systems of disclosure controls and internal controls regarding financial reporting and accounting. During 2015,2017, no member of the Audit Committee served on more than two other public company audit committees. | | | |

Chair: Frances Aldrich Sevilla-Sacasa 1 2 Members: l Heather J. Brunner 2 l Scott S. Ingraham l Renu Khator 2l Kelvin R. Westbrook 1Members:

● William B. McGuire, Jr. 2

● Scott S. Ingraham3

● Frances Aldrich Sevilla-Sacasa

| | 57 |

| | | | | | | | |

Charter last amended February 15, 2013 | | ● Overseeing

l Establish the Company’s general compensation philosophy and oversee the Company’s compensation programs and practices; l Review and● Determining approve corporate goals and objectives relevant to the compensation forof Named Executive Officers, evaluate annually the Company’s executive officers.

performance of the Named Executive Officers in light of the goals and objectives, and determine the compensation level of each Named Executive Officer based on this evaluation; and l Review and approve any employment, severance and termination agreements or arrangements to be made with any Named Executive Officer. | | | | Chair: William F. Paulsen

l Renu Khator 2 l Steven A. Webster l F. Gardner Parker● Steven A. Webster

4 | | 32 |

| | | | | | | | |

Nominating and Corporate Governance Committee

Charter last amended October 28, 2015 | | ● Selecting

l Recommend new Trust Managers to serve on the Company's Board; l Select the Trust Manager nominees for election at annual meetings of shareholders;● Ensuring

l Ensure the Board and management are appropriately constituted to meet their fiduciary obligations to the Company’s shareholders and the Company; and● Developing

l Develop and implementingimplement policies and processes regarding corporate governance matters, including the review, approval or ratification of any transactions between the Company and any Trust Manager or executive officer. | | | | Chair: William B. McGuire, Jr.

l Heather J. Brunner 2 l Scott S. Ingraham●

l Lewis A. Levey● F. Gardner Parker

4 | | 2 |

| | | | | | | | 3 |

| Executive Committee | | ● Approving

l Approve the acquisition and disposal of investments and the execution of contracts and agreements, including those related to the borrowing of money, in instances where a full Board meeting is not possible or practical; and● Exercising

l Exercise all other powers of the Trust Managers in instances where a full Board meeting is not possible or practical, except for those which require action by all Trust Managers or the independent Trust Managers under the Company’s declaration of trust or bylaws or under applicable law. | | | | l William F. Paulsen● Lewis A. Levey

l Kelvin R. Westbrook | | 0 |

| | | | | | | | — |

1 Mr. Westbrook Ms. Sevilla-Sacasa is an “audit committee financial expert,” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K, based on hisher expertise in accounting and financial management. 2 Mr. McGuire resigned fromAppointed effective May 12, 2017.

3 Ceased serving on the Company’sCompany's Audit Committee effective November 2, 2015.May 12, 2017.

34 Mr. Ingraham was appointed to the Company’s Audit CommitteeRetired as Trust Manager effective November 2, 2015.May 12, 2017.

|

| | |

| | 20162018 Proxy Statement 12

13 |

Consideration of Trust Manager Nominees

Shareholder Nominees. The policy of the Nominating and Corporate Governance Committee is to consider all properly submitted shareholder nominations for candidates for membership on the Board. In evaluating such nominations, the Nominating and Corporate Governance Committee will seek to achieve a balance of knowledge, experience, and capability on the Board and to address the membership criteria described below under “Trust Manager Qualifications.” The Nominating and Corporate Governance Committee will apply the same criteria to all candidates it considers, including any candidates submitted by shareholders. Any shareholder nomination proposed for consideration by the Nominating and Corporate Governance Committee should include the nominee’s name and qualifications for Board membership and should be addressed to:Corporate Secretary

Camden Property Trust

11 Greenway Plaza, Suite 2400

Houston, Texas 77046

|

| | | | |

Corporate Secretary Camden Property Trust 11 Greenway Plaza, Suite 2400 Houston, Texas 77046 |

In addition, the Company’s Bylaws permit nominations of Trust Managers at any annual meeting of shareholders by the Board or a committee of the Board or by a shareholder of record entitled to vote at the annual meeting. In order for a shareholder to make a nomination, the shareholder must provide a notice along with the additional information and material required by the Company’s Bylaws to its corporate secretary at the address set forth above not less than 60 nor more than 90 days prior to the date of the applicable annual meeting. However, if the Company does not provide at least 70 days’ notice or prior public disclosure of the date of the annual meeting, the Company must receive notice from a shareholder no later than the close of business on the 10th day following the day on which such notice of the date of the applicable annual meeting was mailed or such public disclosure of the date of such annual meeting was made, whichever first occurs. You may obtain a copy of the full text of the Bylaw provision by writing to the Company’s corporate secretary at the address set forth above. A copy of the Company’s Bylaws has been filed with the SEC as an exhibit to its Current Report on Form 8-K dated March 12, 2013.

Identifying and Evaluating Nominees. The Nominating and Corporate Governance Committee assesses whether any vacancies on the Board are expected due to retirement or otherwise.expected. In the event vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee intends to utilizewill use a variety of methods for identifyingto identify and evaluatingevaluate nominees for Trust Manager. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms, shareholders or other persons. These candidates will be evaluated at regular or special meetings of the Nominating and Corporate Governance Committee, and may be considered at any point during the year. As described above, the Nominating and Corporate Governance Committee will consider all properly submitted shareholder nominations for candidates to the Board. Following verification of the shareholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating and Corporate Governance Committee at a regularly scheduled meeting, which is generally the first meeting prior to the issuance of the proxy statement for the Company’s annual meeting. If any materials are provided by a shareholder in connection with the nomination of a Trust Manager candidate, such materials will be forwarded to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may also review materials provided by professional search firms or other parties, and/or utilize the findings or recommendations of a search committee composed of other Trust Managers, in connection with a nominee who is not proposed by a shareholder. In evaluating such nominations, the Nominating and Corporate Governance Committee will seek to achieve a balance of knowledge, experience and capability on the Board.

Trust Manager Qualifications.Qualifications. The Company’s Guidelines on Governance contain Board membership criteria which the Nominating and Corporate Governance Committee uses in evaluating nominees for a position on the Board. Under these criteria, a majority of the Board must be comprised of independent Trust Managers. The Nominating and Corporate Governance Committee works with the Board to determinate the appropriate characteristics, skills and experiences for the Board as a whole and its individual members with the objective of having a Board with diverse backgrounds and experience. Characteristics expected of each Trust Manager include integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to the Board. In evaluating the suitability of individual Board members, the Nominating and Corporate Governance Committee takes into account an understanding of the Company’s business, including real | | |

| | 2016 Proxy Statement 13

|

estate markets generally, the development, ownership, operation and financing of multifamily communities, and various matters uniqueapplicable to REITs. Thereal estate investing and operations. However, the Nominating and Corporate Governance Committee supports the unique perspective leaders from other industries can bring to the Company. The

Nominating and Corporate Governance Committee also considers a number of other factors, including a general understanding of business operations, finance and other disciplines relevant to the success of a large publicly-traded company in today’s business environment, educational and professional background, personal accomplishment, and geographic, gender, age and ethnic diversity. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group which can best perpetuate the success of the Company’s business and represent shareholder interests through the exercise of sound judgment using its diversity of experience. The Nominating and Corporate Governance Committee evaluates each incumbent Trust Manager on an annual basis to determine whether he or she should be nominated to stand for re-election, based on the types of criteria outlined above as well as the Trust Manager’s contributions to the Board during his or her current term. See the discussion starting on page4950 for a description of the key qualifications of each nominee.

Limits on Service on Other Boards. In the Company’s Guidelines on Governance, the Board recognizes its members benefit from service on the boards of other companies. The CompanyBoard encourages this service but also believes it is critical Trust Managers have the opportunity to dedicate sufficient time to their service on theCamden’s Board. To this end, the Company’s Guidelines on Governance provide employee Trust Managers may not serve on more than two public company boards in addition to Camden’s Board. Neither of the Board.Company’s two employee Trust Managers currently serve on other public company boards. Individuals who serve on five or more than six other public company boards will not normally be asked to join the Board and individuals who serve on more than two other public company audit committees will not normally be asked to join the Company’sCamden’s Audit Committee unless, in any such case, the Board determines such simultaneous service would not impair the ability of such individual to effectively serve on theCamden’s Board or the Company’sCamden’s Audit Committee.

Term Limits; Retirement Age. Trust Managers hold office for one-year terms. The Company’s Guidelines on Governance provide, as a general matter, non-employee Trust Managers will not stand for election to a new term of service at any annual meeting following their 75th birthday. As a result of this policy, Lewis A. Levey and F. Gardner Parker retired from the Board as of May 12, 2017, the date of the 2017 annual meeting of shareholders, and Heather J. Brunner and Renu Khator were appointed to the Board during 2017. The Board may approve exceptions to this practice when it believes it is in the Company’s interest to do so. The Board does not believe it should establish term limits for Trust Manager service, instead preferring to rely upon the mandatory retirement age and the evaluation procedures described above as the primary methods of ensuring each Trust Manager continues to act in a manner consistent with the best interests of the Company, its shareholders, and the Board. The Board believes term limits have the disadvantage of losing the contribution of Trust Managers who have been able to develop, over a period of time, increasing insight into the Company and its operations and, therefore, provide an increasing contribution to the Board as a whole.

Guidelines on Governance and Codes of Ethics

The Board has adopted Guidelines on Governance to address significant corporate governance

issues.issues, which guidelines are available on the Investors' section of the Company’s website at www.camdenliving.com. These guidelines provide a framework for the Company’s corporate governance initiatives and cover a variety of topics, including the role of the Board, Board selection and composition, Board committees, Board operation and structure, Board orientation and evaluation, Board planning and oversight functions, and share ownership of certain officers. The Nominating and Corporate Governance Committee is responsible for overseeing and reviewing the guidelines and reporting and recommending to the Board any changes to the guidelines.

The Board has also adopted a Code of Business Conduct and Ethics, which is designed to help officers, Trust Managers and employees resolve ethical issues in an increasingly complex business

environment.environment, which code is available on the Investors' section of the Company’s website at www.camdenliving.com. It covers topics such as reporting unethical or illegal behavior, compliance with law, share trading, conflicts of interest, fair dealing, protection of the Company’s assets, disclosure of proprietary information, internal controls, personal community activities, business records, communication with external audiences, and obtaining assistance to help resolve ethical issues. The Company has also adopted a Code of Ethical Conduct for Senior Financial Officers, which is applicable to the Company’s principal executive officer, principal financial officer, principal accounting officer,

controller, and persons performing similar functions.

|

| | |

| | 20162018 Proxy Statement 14

15 |

Communication

Withwith the Board

Any shareholder or interested party who wishes to communicate with the Board or any specific Trust Manager, including independent Trust Managers, may write to:

Mr. Lewis A. Levey

Lead Independent Trust Manager

Camden Property Trust

11 Greenway Plaza, Suite 2400

Houston, Texas 77046

|

| | | | |

Lead Independent Trust Manager Camden Property Trust 11 Greenway Plaza, Suite 2400 Houston, Texas 77046 |

Depending on the subject matter,

Mr. Leveythe Lead Independent Trust Manager will:

| ● |

| l | forward the communication to the Trust Manager or Trust Managers to whom it is addressed (for example, if the communication received deals with questions, concerns or complaints regarding accounting, internal accounting controls and auditing matters,compensation, it will be forwarded to the chair of the AuditCompensation Committee for review); |

| ● |

| l | forward to management if appropriate (for example, if the communication is a request for information about the Company or its operations or it is a share-related matter which does not appear to require direct attention by the Board or an individual Trust Manager); or |

| ● |

| l | not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

At each meeting of the Board, the Lead Independent Trust Manager will present a summary of all communications received since the last meeting of the Board and will make those communications available to any Trust Manager on request.

Share Ownership Guidelines

The Board has adopted a share ownership policy for Trust Managers and certain senior officers. The current share ownership policy for Trust Managers provides for a minimum beneficial ownership target of the Company’s common shares with a market value of $250,000 within three years of joining the Board. The current share ownership policy for senior officers provides for a minimum beneficial ownership target of the Company’s common shares, achieved with the lesser of a multiple of base salary or number of shares, within five years of becoming a senior officer, as follows:

|

| | | | |

| | | | |

| Named Executive Officer | | Annual Salary Multiple | | Number of Shares |

| | | | |

President | | 6 times | | 40,500 |

Executive Vice President | | 4 times | | 22,900 |

| | |

Senior Vice President | | 3 times | | 13,200 |

| | |

| | | | |

Each Trust Manager and senior officer

is currently

meetsin compliance with the applicable ownership

target.target guidelines.

Short Selling and Hedging Prohibition

The Company’s Guidelines on Governance provide

thethat Trust Managers and officers may not make “short sales” of any equity security of the Company.

“Short sales”Short sales are defined as sales of securities

that the seller does not own at the time of the sale, or, if owned, securities that will not be delivered for a period longer than

20twenty days after the sale. In addition, Trust Managers and officers may not engage in transactions in derivatives of the Company’s equity securities, including hedging transactions.

|

| | |

| | 20162018 Proxy Statement 15

16 |

We use a combination of cash and share-based compensation to attract and retain qualified candidates to serve on the Board. In setting Board compensation, the Board considers the significant amount of time Trust Managers expend in fulfilling their duties as well as the skill level required by members of the Board.

For

2015,2017, we paid each non-employee Trust Manager an annual fee of

approximately $55,000. A Trust Manager may elect to receive his or her annual fee in

Camden shares.

TheseTo the extent a Trust Manager elects to receive shares, the price used to determine the number of shares is two-thirds of our share price at the time the shares are

valuedissued (i.e., the value of the shares at

the time of grant is 150% of the

cash value of the

annual fee, andcash the Trust Manager would have otherwise received). These shares will vest 25% on date of grant and 25% in each of the next three years, subject to accelerated vesting upon the Trust Manager reaching the age of 65 years.

Historically, most non-employee Trust Managers have tended to elect to receive their annual fees in shares, further aligning compensation with the creation of shareholder value. Also,In addition, each non-employee Trust Manager receives

a fully-vested share

awardsaward with a market value of

approximately $100,000 on the date of grant upon his or her

electionappointment to the Board and on each succeeding year he or she is reelected as a Trust Manager. In

2015,2017, the following additional annual cash fees were paid:

| | | | |

Lead Independent Trust Manager | | $ | 25,000 | |

Chair of the Audit Committee | | $ | 15,000 | |

Chair of the Compensation Committee | | $ | 10,000 | |

Chair of the Nominating and Corporate Governance Committee | | $ | 7,500 | |

Member of the Audit Committee (other than the Chair) | | $ | 8,000 | |

Member of the Compensation Committee (other than the Chair) | | $ | 2,500 | |

Member of the Nominating and Corporate Governance Committee (other than the Chair) | | $ | 2,500 | |

|

| | | |

| Lead Independent Trust Manager | $ | 25,000 |

|

| Chair of the Audit Committee | $ | 15,000 |

|

| Chair of the Compensation Committee | $ | 12,500 |

|

| Chair of the Nominating and Corporate Governance Committee | $ | 8,750 |

|

| Member of the Audit Committee (other than the Chair) | $ | 8,000 |

|

| Member of the Compensation Committee (other than the Chair) | $ | 2,500 |

|

| Member of the Nominating and Corporate Governance Committee (other than the Chair) | $ | 2,500 |

|

The additional annual cash fees paid to the Board Committee chairs were revised as follows effective May 17, 2018:

|

| | | |

| Chair of the Audit Committee | $ | 20,000 |

|

| Chair of the Compensation Committee | $ | 15,000 |

|

| Chair of the Nominating and Corporate Governance Committee | $ | 12,500 |

|

We also reimburse Trust Managers for travel expenses incurred in connection with their activities on the Company’s behalf.

Trust Managers may elect to defer payment of their cash compensation and/or share awards under our deferred compensation plan, the Camden Property Trust Non-Qualified Deferred Compensation Plan.

Director Compensation Table - Fiscal 2017

The table below summarizes the compensation the Company paid to each non-employee Trust Manager for

2015: | | | | | | | | | | | | | | | | | | |

Name (1) | | Fees

Earned

or Paid in

Cash | | | Stock

Awards

(2) | | | Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings (3) | | All Other

Compensation

(4) | | | Total | |

Scott S. Ingraham | | $ | 2,500 | | | $ | 182,506 | | | — | | $ | — | | | $ | 185,006 | |

Lewis A. Levey | | | 27,500 | | | | 182,506 | | | — | | | — | | | | 210,006 | |

William B. McGuire, Jr. | | | 15,500 | | | | 182,506 | | | — | | | 103,504 | | | | 301,510 | |

F. Gardner Parker | | | 5,000 | | | | 182,506 | | | — | | | — | | | | 187,506 | |

William F. Paulsen | | | 10,000 | | | | 182,506 | | | — | | | 141,654 | | | | 334,160 | |

Frances Aldrich Sevilla-Sacasa | | | 8,000 | | | | 182,506 | | | — | | | — | | | | 190,506 | |

Steven A. Webster | | | 2,500 | | | | 182,506 | | | — | | | — | | | | 185,006 | |

Kelvin R. Westbrook | | | 15,000 | | | | 182,506 | | | — | | | — | | | | 197,506 | |

(1) Richard J. Campo, Chairman of the Board and CEO, and D. Keith Oden, President, are not included in this table as they are employees and thus receive no compensation for their services as Trust Managers. The compensation received by Messrs. Campo and Oden as employees is shown in the Summary Compensation Table on page2017:

|

| | | | | | | | | | | | | | | | | | | |

Name (1) | | Fees Earned or Paid in Cash (2) | | Stock Awards (3) | | Change in Pension Value and Non-Qualified Deferred Compensation Earnings (4) | | All Other Compensation(5) | | Total |

| Heather J. Brunner | | $ | 19,222 |

| | $ | 155,076 |

| | — |

| | — |

| | $ | 174,298 |

|

| Scott S. Ingraham | | 10,500 |

| | 182,595 |

| | — |

| | — |

| | 193,095 |

|

| Renu Khator | | 19,222 |

| | 155,076 |

| | — |

| | — |

| | 174,298 |

|

Lewis A. Levey (6) | | 9,167 |

| | 60,853 |

| | — |

| | — |

| | 70,020 |

|

| William B. McGuire, Jr. | | 8,333 |

| | 182,595 |

| | — |

| | $ | 111,624 |

| | 302,552 |

|

F. Gardner Parker (6) | | 1,667 |

| | 60,853 |

| | — |

| | — |

| | 62,520 |

|

| William F. Paulsen | | 11,667 |

| | 182,595 |

| | — |

| | 145,831 |

| | 340,093 |

|

| Frances Aldrich Sevilla-Sacasa | | 12,667 |

| | 182,595 |

| | — |

| | — |

| | 195,262 |

|

| Steven A. Webster | | 2,500 |

| | 182,595 |

| | — |

| | — |

| | 185,095 |

|

| Kelvin R. Westbrook | | 21,667 |

| | 182,595 |

| | — |

| | — |

| | 204,262 |

|

| |

| (1) | Richard J. Campo, Chairman of the Board and CEO, and D. Keith Oden, President, are not included in this table as they are employees and thus receive no additional compensation for their services as Trust Managers. The compensation received by Messrs. Campo and Oden as employees is shown in the Summary Compensation Table on page 39. |

| |

| (2) | This column reflects the annual cash fees paid in 2017 to the non-employee Trust Managers and for service on Board committees as described above. |

| |

| (3) | 38.(2) The dollar amount reported is the aggregate grant date fair value of awards granted during the year computed in accordance with ASC 718, Compensation-Stock Compensation. Assumptions used in the calculation of these amounts are included in note 11 to the audited consolidated financial statements for the year ended December 31, 2017 included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.

|

On May 12, 2017, each non-employee Trust Manager (other than Messrs. Levey and Parker who did not continue as Trust Managers after our 2017 Annual Meeting of Shareholders) received an annual fully vested share award with a grant date fair value of

awards granted during$100,000 (with the

year computed in accordancedifference between the $100,000 amount and the amount referenced above being due to rounding to whole shares). On May 12, 2017, each non-employee Trust Manager elected to receive a share award with

ASC 718,Compensation-Stock Compensation. Assumptions useda grant date value of $82,500 (150% of the value of the cash the Trust Manager would have received otherwise), that vests over three years as described above. The difference between the $82,500 and the amount referenced above being due to rounding to whole shares. The differences in the

calculation of these amounts are included in note 10payments to Mses. Brunner and Khator detailed above is due to the

audited consolidated financial statements fortiming of their appointment to the

year ended December 31, 2015 included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015.Board.

|

| | |

| | 20162018 Proxy Statement 16

18 |

As of December 31,

2015,2017, none of the non-employee Trust Managers held any vested or unvested

ordinary share options and such persons held the following numbers of

vested and unvested share awards,

in each case related to

non-employee Trust Manager annual fees:

| | | | |

Name | | Vested Share

Awards | | Unvested Share

Awards |

Scott S. Ingraham | | 32,099 | | 2,482 |

Lewis A. Levey | | 25,324 | | - |

William B. McGuire, Jr. | | 3,022 | | - |

F. Gardner Parker | | 33,410 | | - |

William F. Paulsen | | 12,160 | | - |

Frances Aldrich Sevilla-Sacasa | | 7,868 | | 2,304 |

Steven A. Webster | | 40,663 | | 1,724 |

Kelvin R. Westbrook | | 14,920 | | 2,482 |

(3) The Company does not have a pension plan. There were no earnings on nonqualified deferred compensation which were above-market or preferential.

(4) Represents amounts paid pursuant to a defined post-retirement benefit plan relating to prior service with Summit Properties Inc. for health benefits, secretarial and computer-related services, and office facilities.

|

| | |

| | 2016Unvested Share Awards

|

| Heather J. Brunner | | 756 |

| Scott S. Ingraham | | 1,509 |

| Renu Khator | | 756 |

| Lewis A. Levey | | — |

| William B. McGuire, Jr. | | — |

| F. Gardner Parker | | — |

| William F. Paulsen | | — |

| Frances Aldrich Sevilla-Sacasa | | 1,509 |

| Steven A. Webster | | — |

| Kelvin R. Westbrook | | 1,509 |

| |

| (4) | The Company does not have a pension plan. There were no earnings on non-qualified deferred compensation for Trust Managers which were above-market or preferential. |

| |

| (5) | Represents amounts paid pursuant to a defined post-retirement benefit plan relating to prior service with Summit Properties, Inc. for secretarial and computer-related services, and office facilities. These benefits are not provided with respect to, nor are they contingent upon, their respective service on the Board. |

| |

| (6) | Messrs. Levey and Parker retired from the Board effective May 12, 2017. They did not receive any amounts related to service subsequent to such time. |

|

| | |

| | 2018 Proxy Statement 1719 |

There

isare no family

relationshiprelationships among any of the Trust Managers or executive officers. No executive officer was selected as a result of any arrangement or understanding between that executive officer and any other person. All executive officers are elected annually by, and serve at the discretion of, the Board.

The Company’s current

executive officersNamed Executive Officers and their ages, current positions and recent business experience (all of which was with the Company) are as follows:

|

| | | | |

Name | | Age | | Position |

| Richard J. Campo | | 6163 | | Chairman of the Board and CEO (May 1993-present) |

| | | | |

| D. Keith Oden | | 5961 | | President (March 2008-present); President and Chief Operating Officer (May 1993-March 2008) |

| | | | |

| H. Malcolm Stewart | | 6466 | | Chief Operating Officer (March 2008-present) |

| | | | |

William W. Sengelmann | | 57 | | Executive Vice President-Real Estate Investments (December 2014-present); Senior Vice President – Real Estate Investments (March 2008-December 2014) |

| | | | |

| Alexander J. Jessett | | 4143 | | Executive Vice President-Finance, Chief Financial Officer and Treasurer (December 2014-present); Senior Vice President, Chief Financial Officer and Treasurer (May 2013-December 2014); Senior Vice President –- Finance and Treasurer (December 2009-May 2013) |

| William W. Sengelmann | | 59 | | Executive Vice President-Real Estate Investments (December 2014-present); Senior Vice President - Real Estate Investments (March 2008-December 2014) |

|

| | |

| | 20162018 Proxy Statement 18

20 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The following table shows how many shares were owned by the Trust Managers,

nominees for Trust Manager and executive officers as of March

16, 2015,20, 2018, including shares such persons had a right to acquire within 60 days after March

16, 201520, 2018 through the exercise of vested options to purchase shares held in a rabbi trust, ordinary share options and through the exchange of units of limited partnership interest in the Company’s operating partnerships. The following table also shows how many shares were owned by beneficial owners of more than 5% of the Company’s common shares as of March

16, 2015.20, 2018. Unless otherwise noted, each person has sole voting and investment power over the shares indicated below.

| | | | | | |

| | | Shares Beneficially Owned(2)(3) |

Name and Address of Beneficial Owners(1) | | Amount | | | Percent of Class(4) |

The Vanguard Group, Inc.(5) | | | 12,685,065 | | | 14.6% |

BlackRock, Inc.(6) | | | 8,875,697 | | | 10.2% |

Vanguard Specialized Funds – Vanguard REIT Index Fund(7) | | | 6,256,680 | | | 7.2% |